What it is

Conservative investing is an investing approach where you’ll focus on protecting your money rather than chasing high returns.

This method is appropriate for investors who only want to take very little risk when it comes to growing their money.

What it means for you

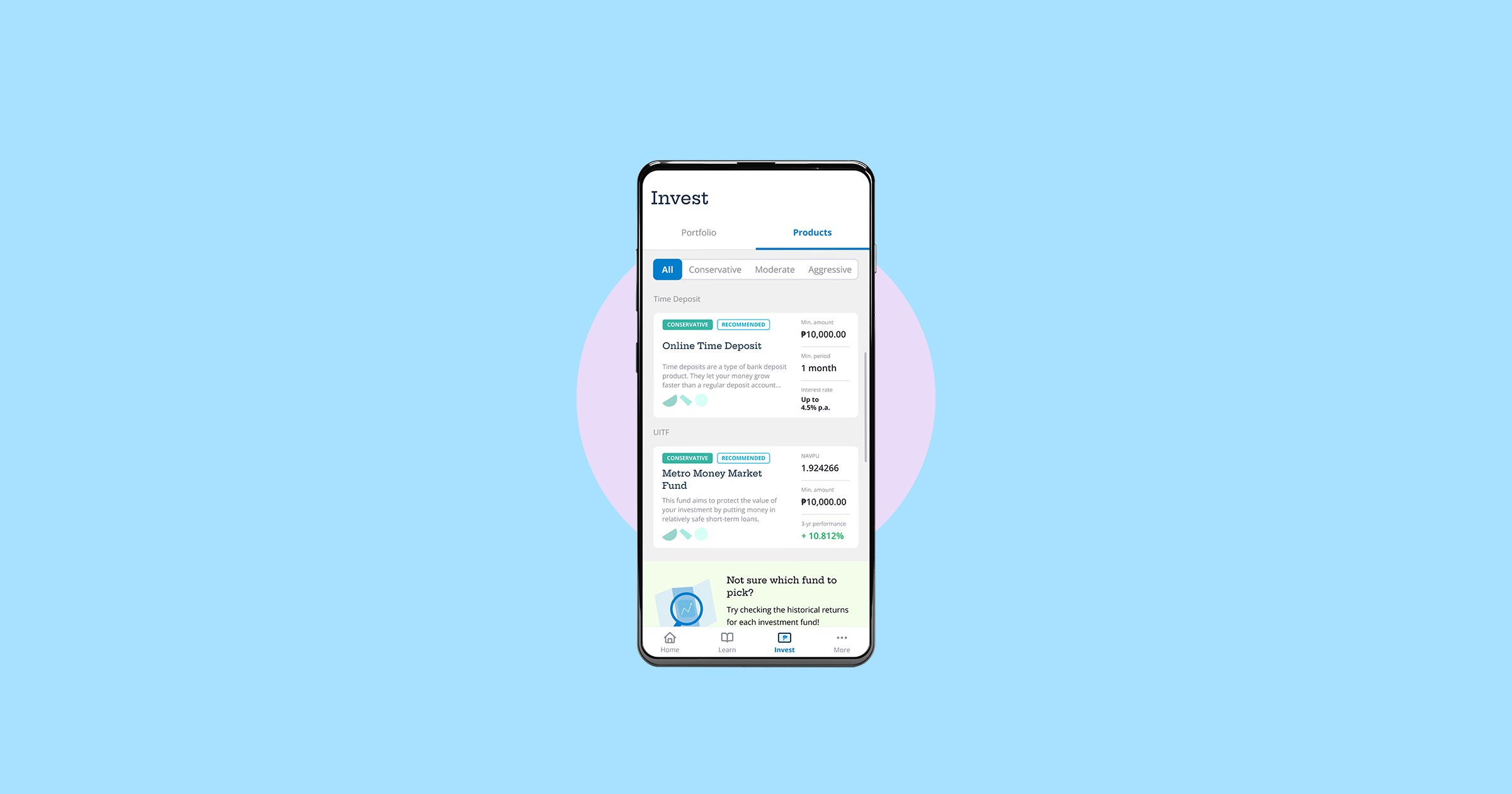

When you take a risk assessment before you invest, you’ll find out whether you’re a Conservative, Moderate, or Aggressive investor.

Your result will determine the products you can consider given your emotional and financial capacity to take risks.

As a conservative investor, your main goal is to preserve capital and so you’ll choose low-risk investments like money market funds and government securities.

Since they bear low risk, these products also typically offer lower returns, especially when compared with the potential returns of higher-risk products.

A person may go the route of conservative investing if they’re only starting out and don’t have much investing knowledge yet. Those who are approaching retirement or dealing with financial constraints may also have a conservative outlook.

Even aggressive and moderate investors may adopt a conservative stance from time to time when there’s a downturn in the markets or if a significant event is causing uncertainty.

_large.png)