What it is

A return is the change in value of an investment over a certain period. It represents the performance of an investment, showing whether it’s up or down.

A positive return means you turned a profit while a negative return means you lost money. Take note that the profit or loss will only become real once you sell your investment or when it reaches maturity.

What it means for you

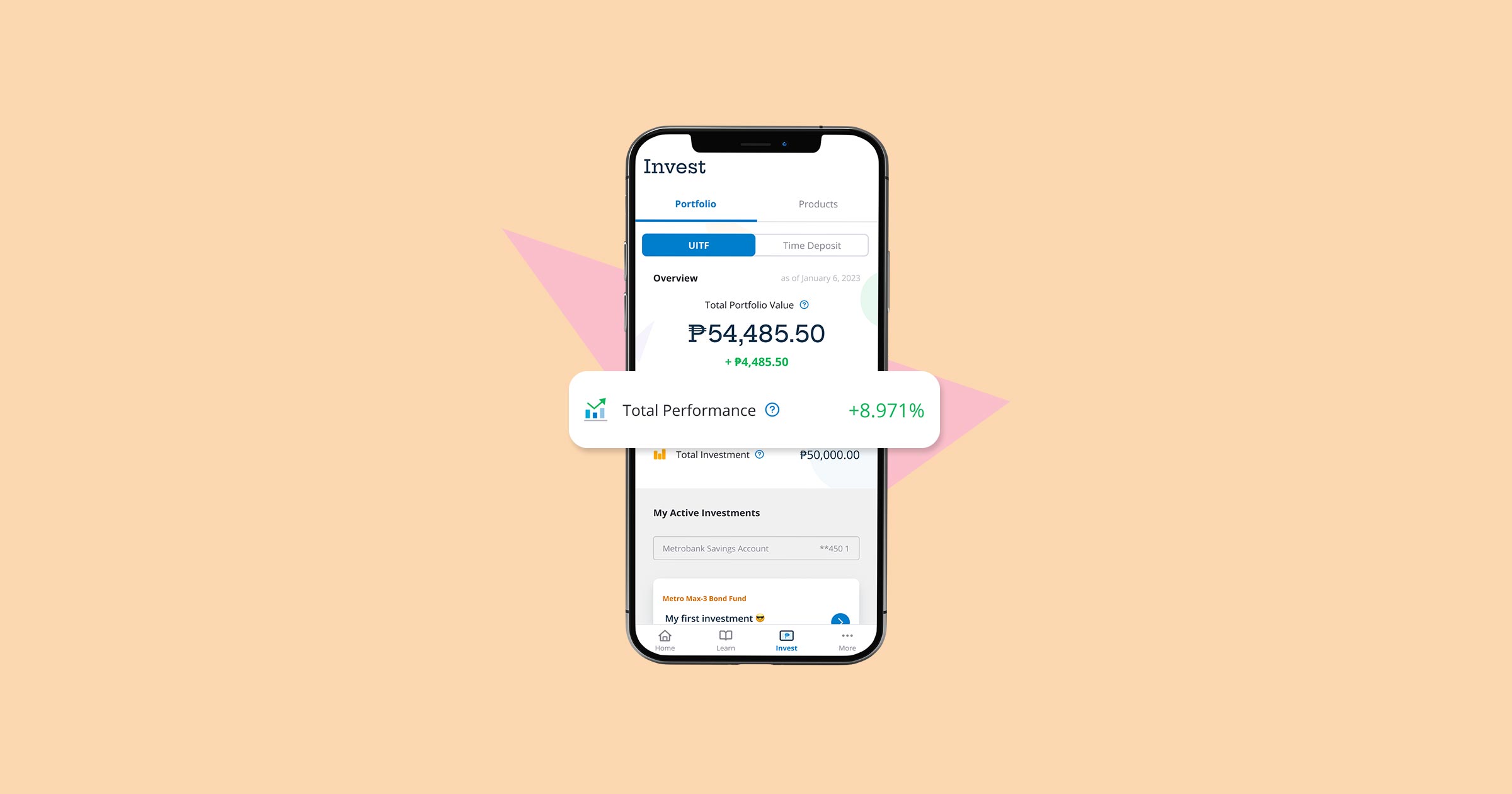

You can check how well your existing investments are doing by calculating their returns. If you’re considering a new investment, its historical returns serve as one way to tell how it has done in the past.

There are different types of returns and different ways to calculate them. A simple way to know the return on an investment is to subtract your purchase price from the current price or the selling price.

For example, let’s say you bought 100 shares of a company’s stock for P15 per share and eventually sold everything for P20 per share. Your return in pesos is P500 and the rate of return is about 33%.

This example only factors in profit from the price increase or the capital gain. It doesn’t include any dividends that could add to your earnings or any fees or taxes that may be taken out of your profit.

Here are two types of returns to consider:

- Nominal return

This shows how much you gained or lost from an investment in pesos or other currencies. It includes your profit but does not factor in taxes, inflation, or other fees.

- Real return

This is the amount you’ll actually get from your investment after accounting for inflation, taxes, and applicable fees.

To track an investment’s performance, you may want to check annual or year-on-year returns. A month-on-month price comparison can also give you a short-term view of whether an investment is growing.

Just keep in mind that it might not be a good idea to check on your investments too often. This is because it can take time for some assets to increase in value. Long-term trends might offer a better view of their growth potential.