Every Unit Investment Trust Fund (UITF) has a Key Information and Investment Disclosure Statement (KIIDS) so you can assess if it’s a good fit for you.

You’ll see things like the fund’s portfolio composition (the assets it holds), performance (how well it has done over time), and what type of risk profile it’s right for. Read on to learn the major parts of a KIIDS and what to expect in each one.

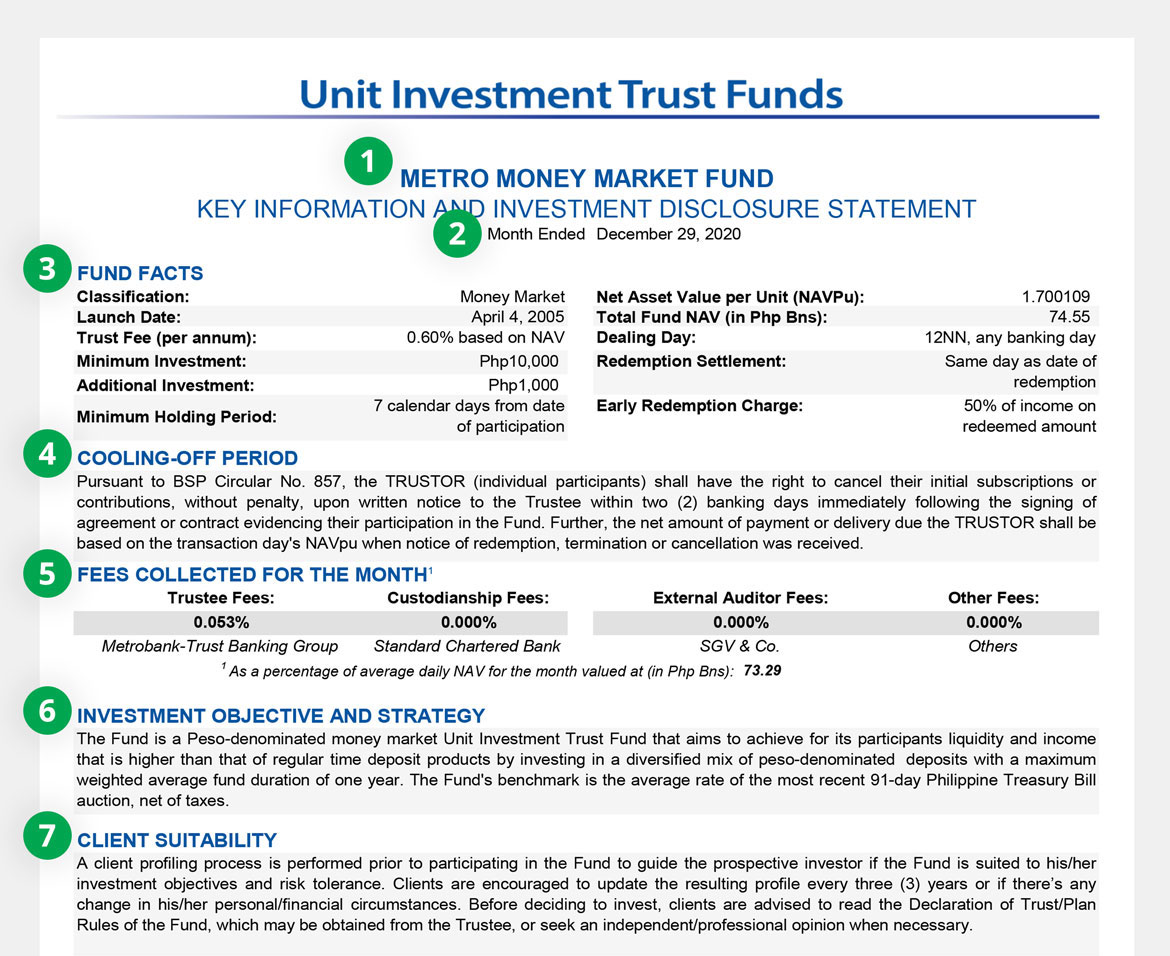

1. Fund name

This is usually an indicator of the fund’s focus or type. In this example, this is a UITF that contains money market instruments, which are short-term debt securities.

2. Month covered

Fund fact sheets are required to be available at least every quarter, although these are usually updated monthly with the exact date varying according to bank. The performance, statistics, outlook and strategy are refreshed with each update.

You may sometimes see slight differences in the portfolio composition or percentage of the fund that goes to the top 10 holdings.

3. Fund facts

These give you a quick overall view of the fund.

- Classification- The type of fund.

- Launch date- The date when the fund started.

- Trust fee- The fee charged for managing the fund.

- Minimum investment- The minimum amount needed to start investing in this fund.

- Additional investment- The minimum amount needed to add to an existing investment in this fund.

- Minimum holding period- The shortest time you can keep your money invested in this fund without paying an early redemption charge.

- Net Asset Value Per Unit- The price per unit of participation in this fund, usually referred to as the NAVPU. The money you invest in this fund is used to purchase these units.

- Total Fund NAV- The total value of the fund.

- Dealing day- The daily cut-off time for your investment to be processed the same banking day.

- Redemption settlement- The day the amount you redeemed from your investment in this fund will be credited to your settlement account.

- Early redemption charge- The fee to be charged to your income when you redeem some or all of your investment within the minimum holding period.

4. Cooling-off period

This is the time period in which you can cancel your investment without being charged any penalty. The minimum duration is 2 days, according to the regulations set by the Bangko Sentral ng Pilipinas.

5. Fees collected for the month

This is the summary of all monthly fees. These are already factored into the NAVPU, so you don’t have to worry about paying them separately.

6. Investment objective and strategy

This is the overall view what the fund is trying to achieve and how it plans to get there. It also includes the fund’s performance benchmark, which it will try to match or even beat.

7. Client suitability

This shows the type of investor that this fund would be right for, including the risk profile, money goal, and investment horizon.

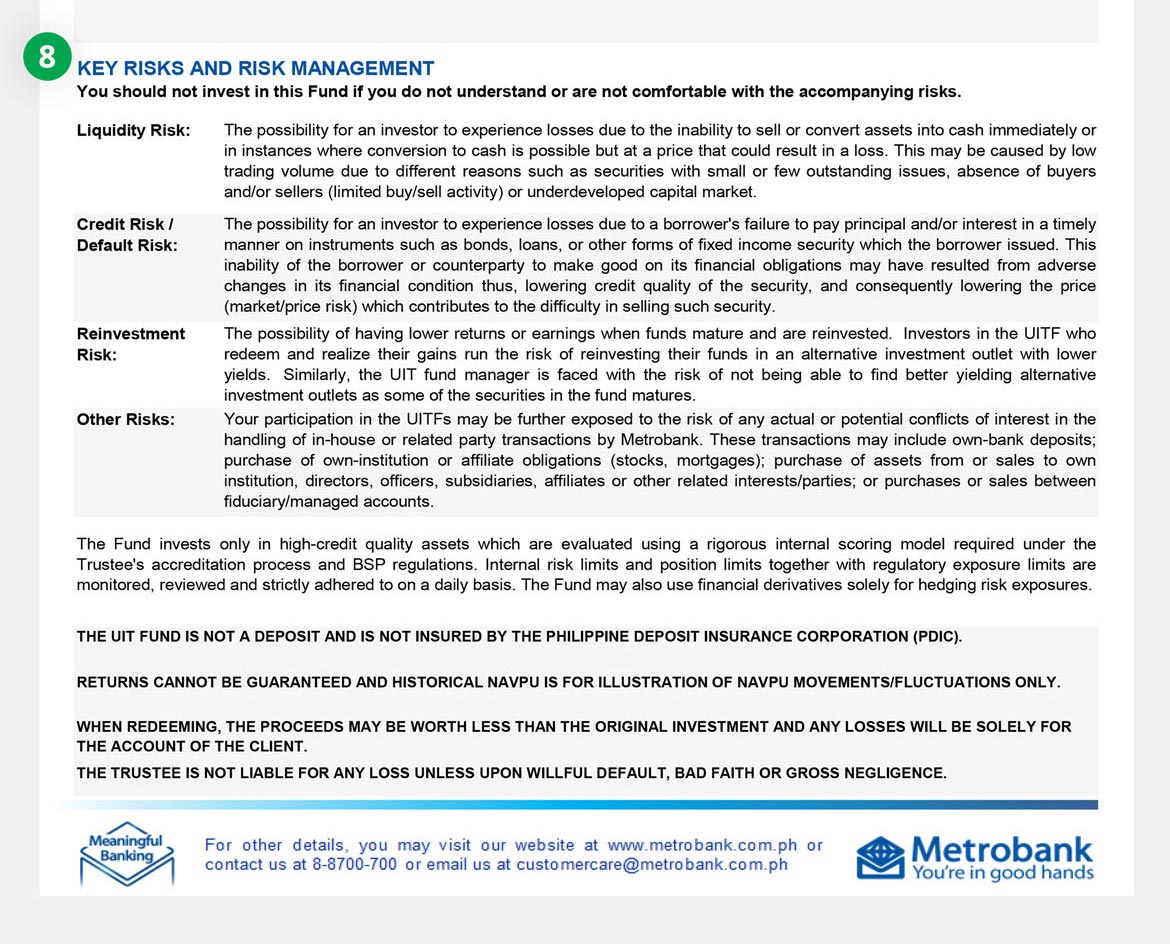

8. Key risk and risk management

This is a summary of if you choose to invest in this fund, and how the trustee manages these risks.

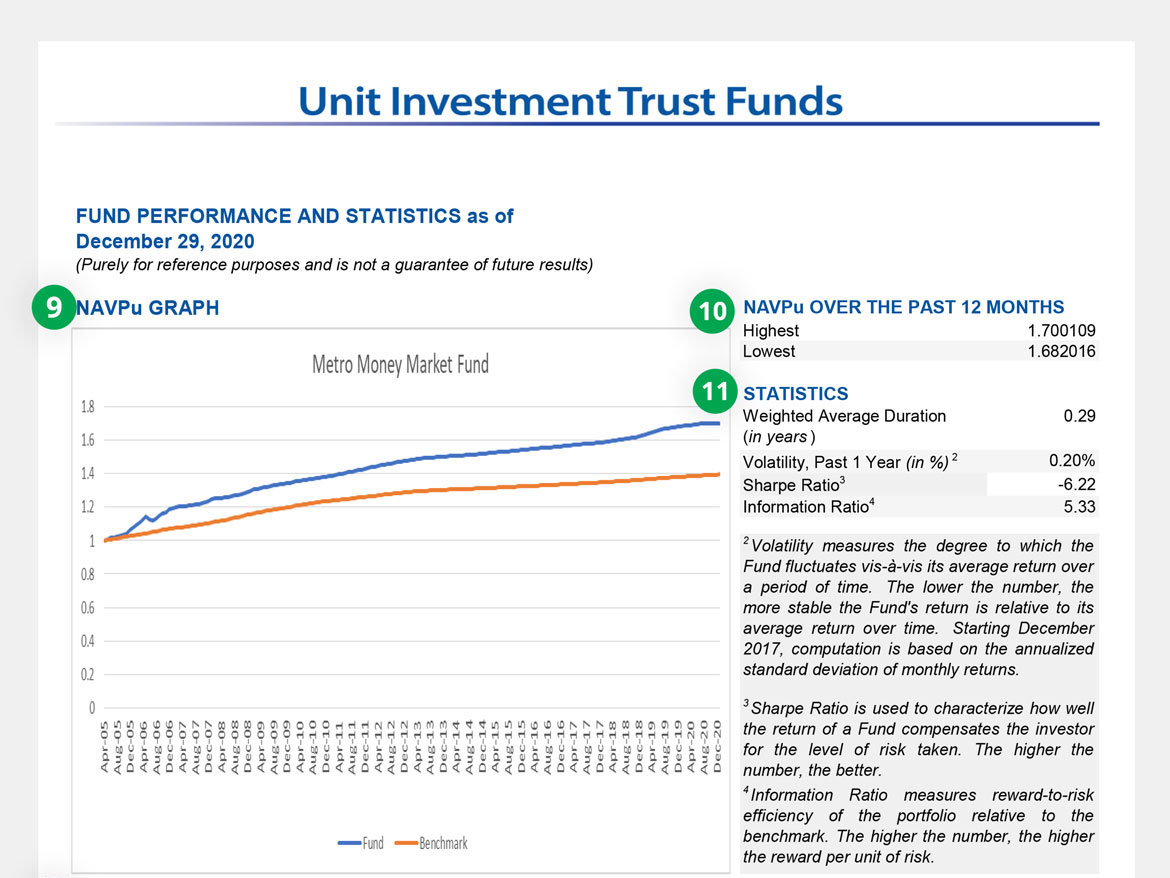

9. NAVPU graph

This shows the fund’s historical performance as measured in terms of NAVPU. It is compared to the fund’s benchmark in order to give you an idea of how well it has been managed.

10. NAVPU over the past 12 months

This is a quick reference for the highest and lowest values of the NAVPU in the past 12 months.

11. Statistics

These give you more information on how the fund has performed over time.

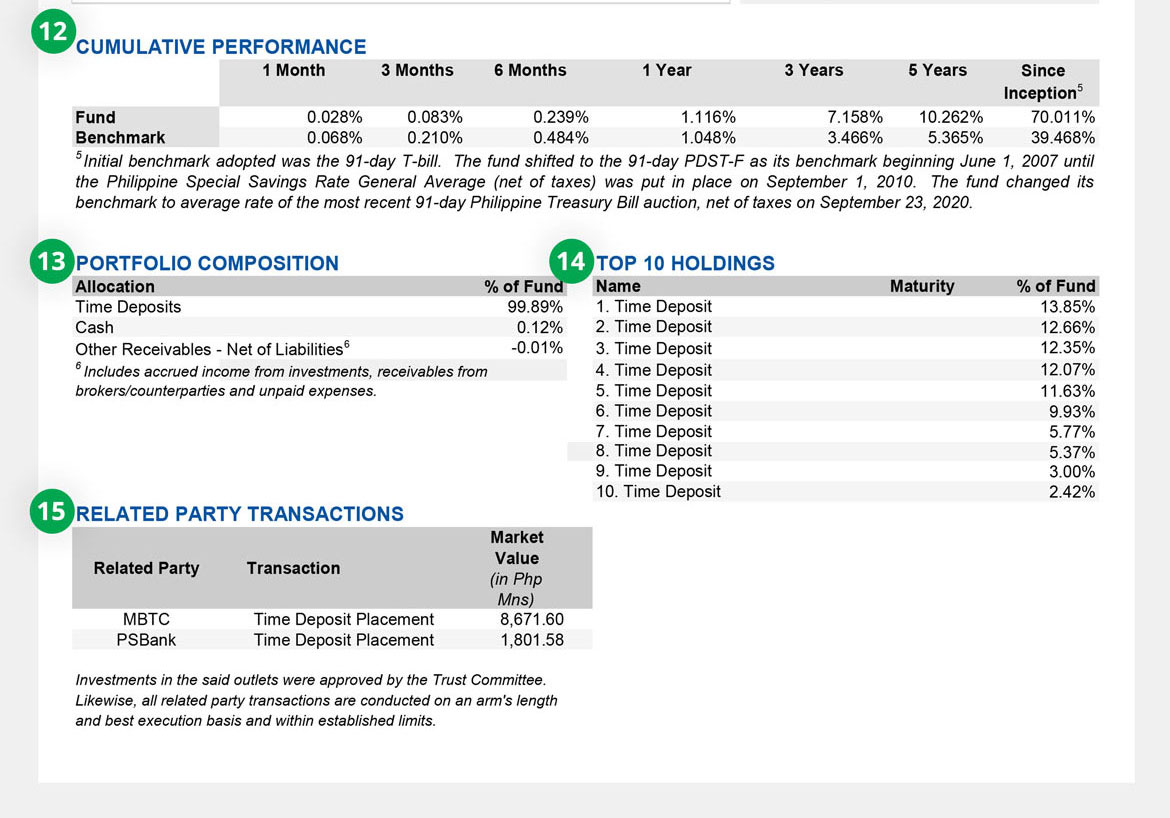

12. Cumulative performance

This is another place where you can see the performance of both the fund and its benchmark. It’s similar to the NAVPU graph but expressed as a percentage to make it easier to compare.

13. Portfolio composition

This is where you can see the asset types that the fund contains. Every fund has assets that are meant to help it achieve its objective, and these assets are mostly what determine the risk profile suitability of the fund.

14. Top 10 holdings

These are the fund’s primary assets, presented according to how much of the portfolio they take up.

15. Related party transactions

This is where, for full disclosure, transactions (including assets held) made with companies or organizations that can be said to be related to the company offering the fund.

16. Investment policy

This lets you know the asset types that the fund manager can choose to add to the portfolio.

17. Outlook and strategy

This provides market information and recent developments that can directly affect the fund, and can also include how the fund manager plans to react to them.

.jpg)