While learning about investing, you may have come across a strategy called “buying the dip.” What does this mean? Is this something you should consider doing and, if so, how?

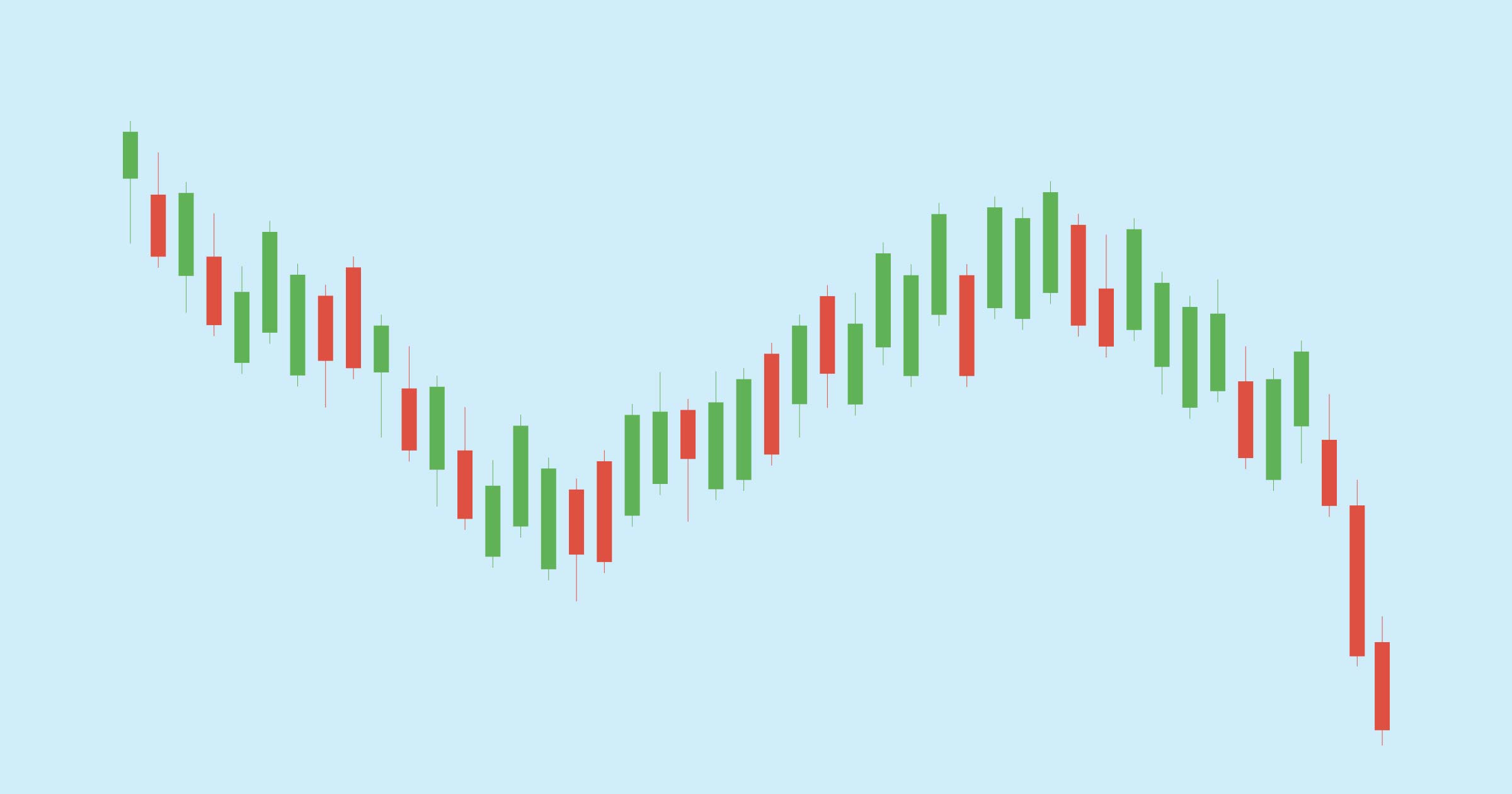

No matter the way, shape or form, you make money in investing if you are able to buy an asset low and eventually sell it high. In this regard, “buying the dip” means acquiring an investment outlet that has temporarily gone down in value with the expectation that its price will rise again fairly soon (meaning, you’ll make money).

This strategy is usually seen in the capital markets, although it is done across other assets too.

How do you buy the dip?

There are 2 popular approaches to this strategy, both of which involve buying an asset whose price dropped but has the potential to go back up soon.

In the first approach, the asset you’re considering buying should have a long-term uptrend. This means that it has been steadily growing in value for some time, and so there’s a good chance that the price decline is only temporary.

The second doesn’t require this uptrend, just your personal belief in its potential to rise again soon. This could come from many things, like if you feel that the dip is caused by an issue that doesn’t really impact the asset’s worth, or if you feel that a major news was misinterpreted, or perhaps if you are confident that the strong fundamentals would eventually kick in.

If you made the right decision, the asset gets more expensive. You’ll then have to decide whether to lock in your gains already by selling for a profit, or to hold on for even better days and more potential returns.

Things to remember

Regardless of which of the 2 approaches you subscribe to, there needs to be a substantial reason for the asset’s price to rise in the near future. If you don’t see anything that could make this happen, that could be a sign that instead of a dip, it is actually a downtrend.

The need for this rebound/growth potential is actually what makes buying dips difficult. After all, there are no guarantees in investing, and so an asset that has become less expensive may not rise in value even after some time.

Even experts can have a hard time identifying telling a dip from the start of a downtrend, and so buying the dip isn’t something that you should do without a lot of consideration. In fact, it isn’t recommended for people who’ve just started their investing journey.

If you still choose to buy the dip, you can manage your risk a bit by setting a limit for your possible losses. For example, if you bought 1,000 shares of a company at P30 each, you could make P28 your limit.

If things go as planned and the shares rise beyond P30, you’ll have made money. However, if the price continues to slide, you’ll sell the shares for P28,000. While this means an actual loss of P2,000, it might be a better decision than holding on only to see the value drop even more.

There are even investment platforms and mobile apps out there which have automatic buy on breakout and cut-loss features to help you maximize your gains and even better manage your downside risks.

.jpg)