What it is

A sell-off is an event that happens in financial markets when a lot of investors decide to sell their assets quickly, causing prices to drop significantly.

It can happen for different reasons like negative news affecting specific companies, signs of weakness in the broader economy, or anything that causes fear among investors.

What it means for you

Sell-offs can happen with specific asset types like stocks or bonds. Such events can also impact entire sectors or even markets.

For example, if a company announces disappointing earnings, a large number of investors might sell their shares of that company.

On a larger scale, if there’s a sudden shift in economic policy, there might be a sell-off in a wider range of affected assets or sectors.

Sometimes, sell-offs are part of a bigger downward trend or economic event, like a bear market or recession.

They may also be short-lived when caused by an overreaction or negative forecasts that don’t end up happening.

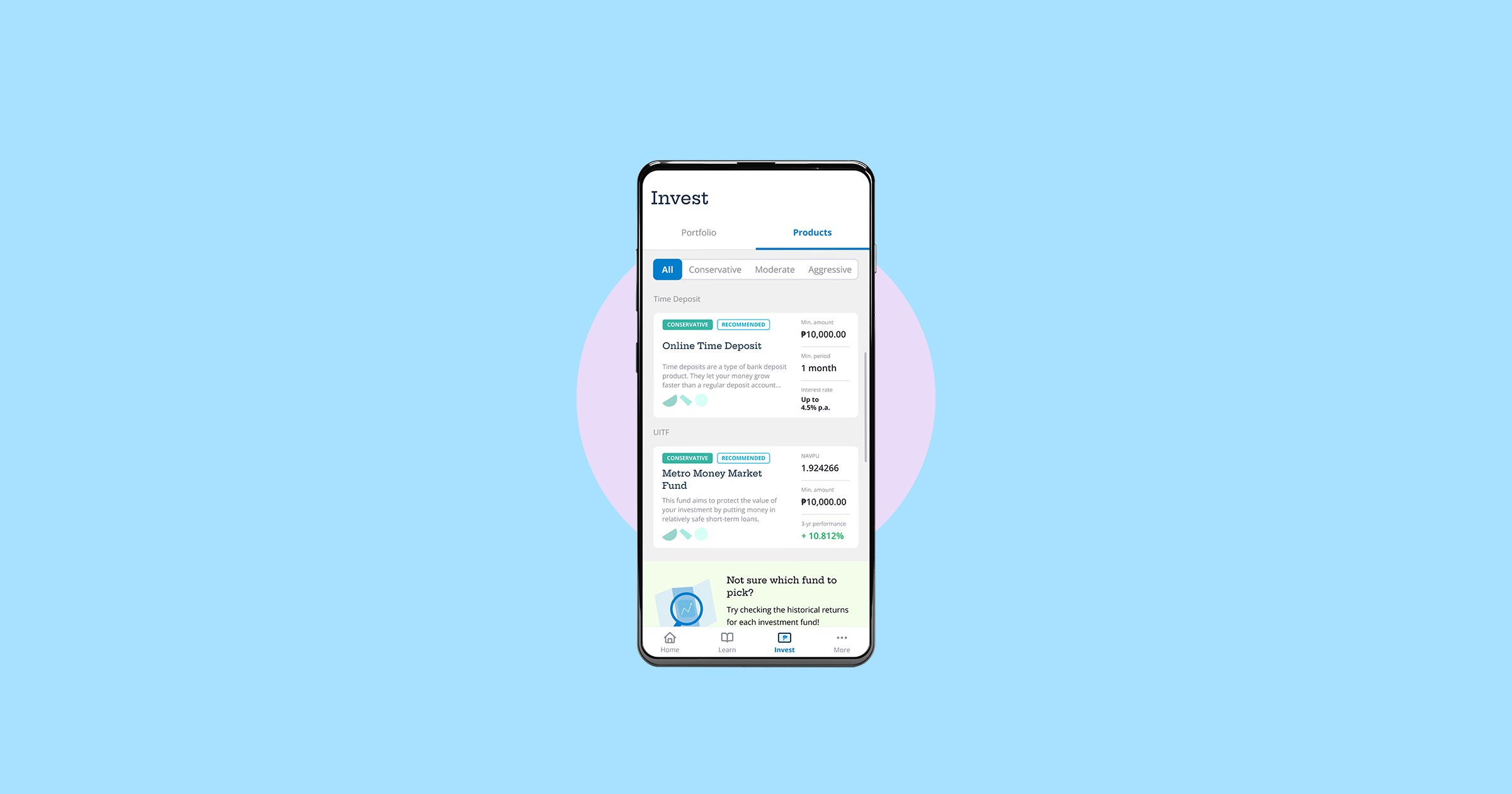

As an investor, it’s important to understand that sell-offs don’t necessarily mean the market is in trouble for the long term.

It’s best to remain calm, avoid impulsive moves, and always keep your goals and strategy in mind before making big investing decisions.