What it is

Speculation or speculative trading is the act of buying and selling assets in hopes of profiting from changes in price. Although some people think that it’s the same as investing, there are key differences between the two.

When a profit-making opportunity is speculative, returns are almost entirely dependent on price fluctuations. Success depends mostly on chance or other unpredictable factors.

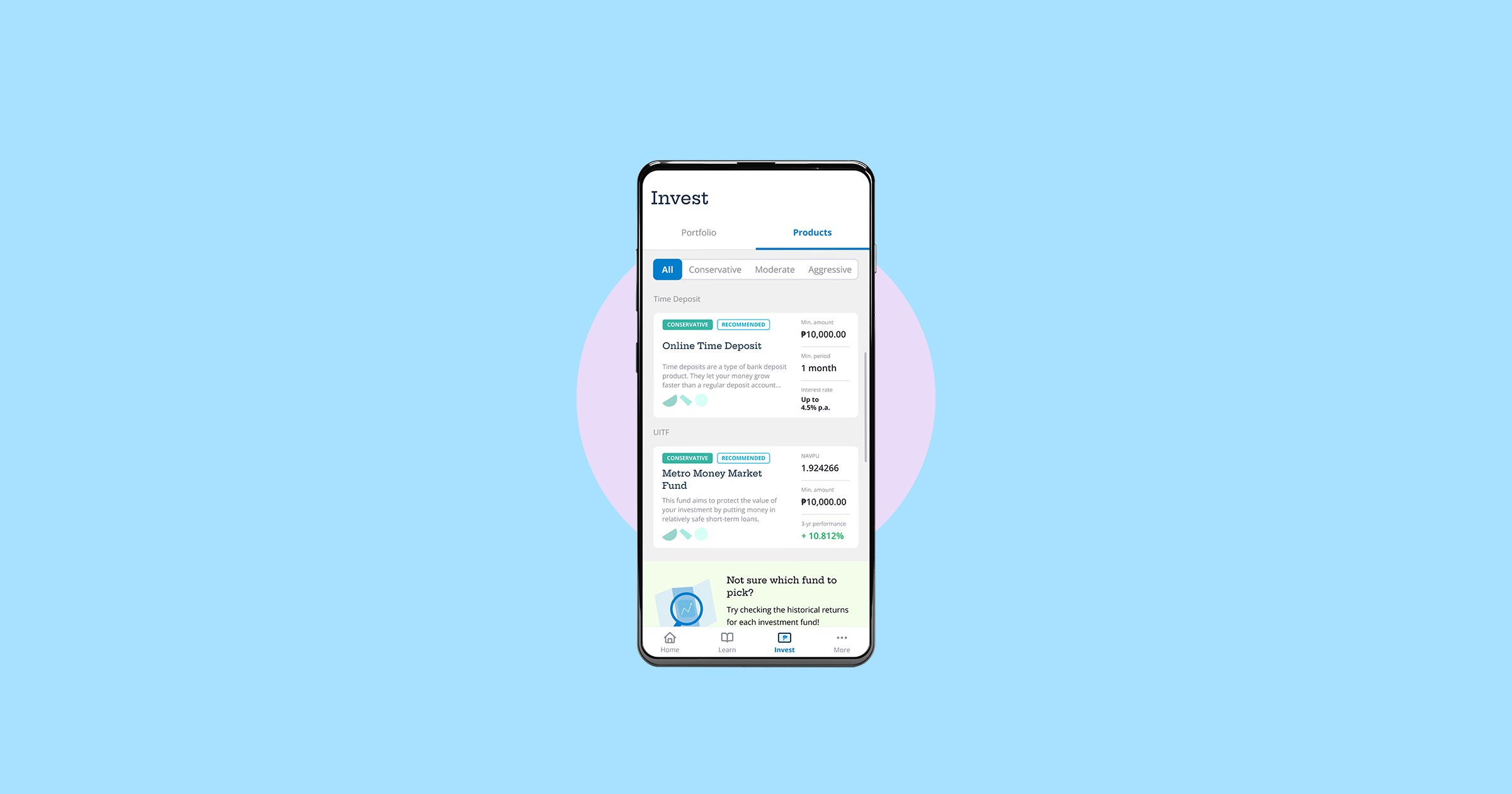

People often speculate on niche and relatively new asset classes, or products with high volatility. However, speculation can also be done with traditional investments.

Unlike other investors, speculators don’t care much about an asset’s long-term growth potential. That’s because they want to make a lot of money within a short time span.

In exchange for high possible profits, speculators typically accept an elevated risk of losing money. The decision-making process can vary from one speculator to another.

Some traders are more methodical, and they try to predict supply and demand through technical analysis. Others make decisions by following the news or by relying on a hunch or on online trends.

What it means for you

Speculative trading has the potential to affect you as an investor even if you don’t participate in it. It helps add liquidity to the market since participants tend to transact several times within a short period to take advantage of price movements.

This method can also have negative effects. Speculators may cause panic selling if too many people drive up the price of certain assets and sell off their positions all at once.

Ultimately, speculating is a practice that’s best left to those who can withstand significant risk. Before getting involved, it’s important to know what can happen and learn the skills that you’ll need.