As a new investor, you can ease into your investing journey by exploring pooled funds like Unit Investment Trust Funds (UITFs).

These products are a good starting point for people who’d like to invest but are not yet confident with their skillset.

Instead of monitoring the market and making investment decisions on your own, you’ll get the help of experts who’ll take care of the fund for you.

To increase your potential to succeed, here are a few mistakes to avoid and smart practices to follow.

The Don’ts: Common mistakes to avoid

1. Invest in what you don’t understand

Jumping into an investment without doing enough research is a common mistake beginners make. They may do so due to the promise of high returns or simply because someone told them to invest.

To avoid flying blind, you should understand how UITFs work, the assets they invest in, and the factors that may affect their value.

It’s important to read essential documents about the UITF you’re interested in, like its fund fact sheet, before putting your money in.

While doing your research, keep in mind that not all UITFs will be a good fit for you given your unique situation and goals.

Need a refresher on how UITFs work? Read our guide here.

2. Rely on past performance alone

Historical returns can show you how a UITF has performed over time. While past performance can help you compare options, it’s not a guarantee of what you might earn in the future.

Market conditions can change and affect the value of investments. Making a smart choice involves looking at other factors like a UITF’s risk suitability and whether its features can help you meet goals.

3. Withdraw too early

On the fund fact sheet, you’ll see a recommended time horizon for each UITF. This is the ideal length of time to keep your money invested in the fund to possibly get favorable returns.

If you’ll withdraw sooner, your money might not have enough time to grow. That’s why you shouldn’t invest money you’ll need right away, especially if you’re investing in medium- or long-term UITFs.

It’s also ideal to build an emergency fund so you can cover unexpected expenses without taking money out of investments prematurely.

4. Give in to panic

Market downturns can be nerve-wracking for any investor, and beginners may feel the pain of loss more strongly than others.

If you let panic get the best of you and so withdraw during a dip, you may end up losing money and missing the chance for your investment to recover and possibly grow in the long run.

Give yourself time to analyze the situation and properly identify if there’s a good reason to turn your paper losses into actual losses.

The Dos: How to properly invest in UITFs

1. Consider your risk profile

Before investing in UITFs, you need to take a risk assessment. This will tell you whether you’re a Conservative, Moderate, or Aggressive investor.

There are different products that suit different risk profiles. It’s ideal to choose a product that matches your profile or has a lower risk suitability.

You may also turn out to be Risk Averse, which means you can’t invest in UITFs yet.

However, your risk profile may change as you gain experience and go through different life situations.

It’s wise to retake the assessment periodically so you can adjust your investing approach if your risk profile has changed.

2. Learn about your options

There are many types of UITFs, and they are classified according to their underlying assets and structure.

Aside from looking at the risk suitability and historical returns, you can also narrow your options by picking the investment fund that has the best strategy, asset allocation, and objective to match your needs and goals.

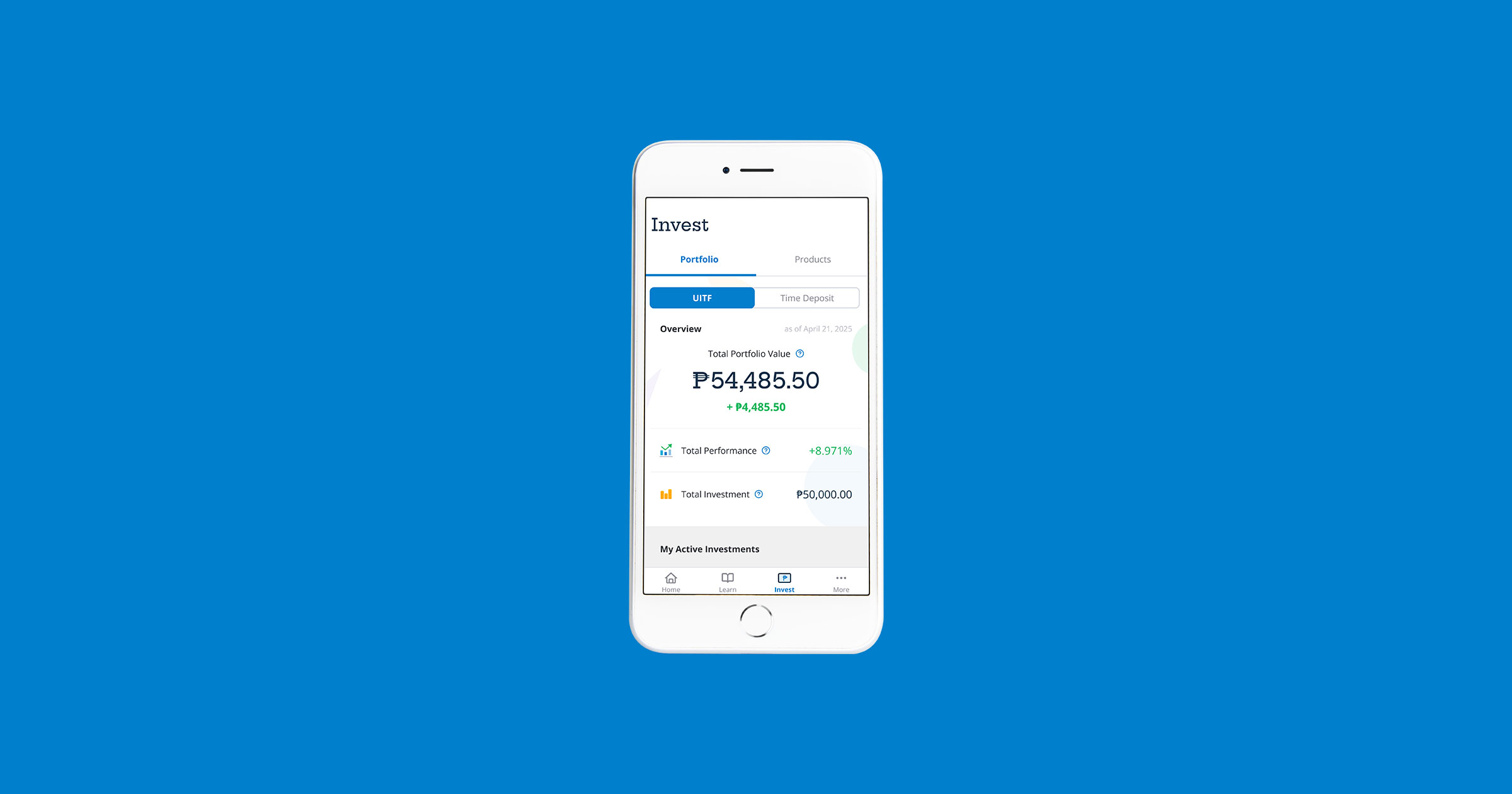

3. Add money consistently

Investing a fixed amount regularly, regardless of market conditions, can save you the stress of trying to invest at the “right time.”

This approach is called peso-cost averaging. It allows you to start small, build your investments over time, and minimize risk by spreading out your purchases instead of investing a huge amount all at once.

4. Check the fees

UITFs tend to come with management fees and other charges that can affect your returns. These are usually expressed as a percentage of your investment.

Compare fees of different funds and understand what you're paying for to know if it’s worth it.