When you visit a Unit Investment Trust Fund (UITF) product page on Earnest, you’ll find a lot of useful and interesting details in it. Read on to learn how to use all the information to see if the fund is a good fit for you.

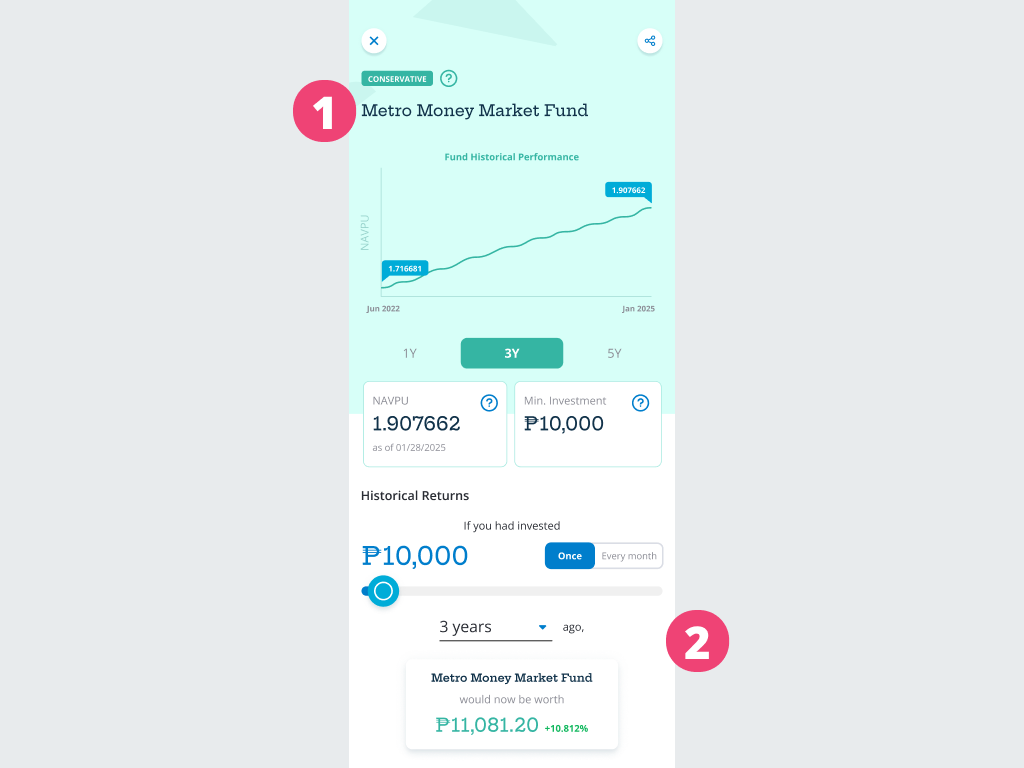

1. Fund name

The name can tell you what type of fund it is. For example, if the name has “equity” in it, then the fund focuses on stocks. The same goes for funds that have “bond” and “money market” in their names.

Above the name is the recommended risk profile for investing in the fund. If you’re Aggressive, you can still choose a fund that matches a Moderate or Conservative profile too. If you’re Moderate, you can also put money in a fund that fits a Conservative profile. Before investing, you’ll need to take a risk assessment so you’ll know your risk profile.

The background color is an easy way for you to tell the risk suitability of the fund. Products that fit an Aggressive risk profile are in purple, while those for Moderate and Conservative profiles use yellow and green, respectively.

You'll also see the Net Asset Value Per Unit or NAVPU, which is how much a single unit of the fund is currently worth. When you invest in the fund, you get units that represent how much you put in. If the NAVPU now is higher than the NAVPU when you first invested, that’s good news because you’ve made a profit.

2. Historical returns

This sample calculation allows you to see your theoretical returns if you had put money in the fund 1 year, 3 years, or 5 years ago.

Don’t forget that past performance isn’t a guarantee of future results, and so the returns you get may be different from what the fund has delivered before.

Since performance is tracked on a 1-year, 3-year and 5-year basis, funds that haven’t existed that long can’t display a corresponding result.

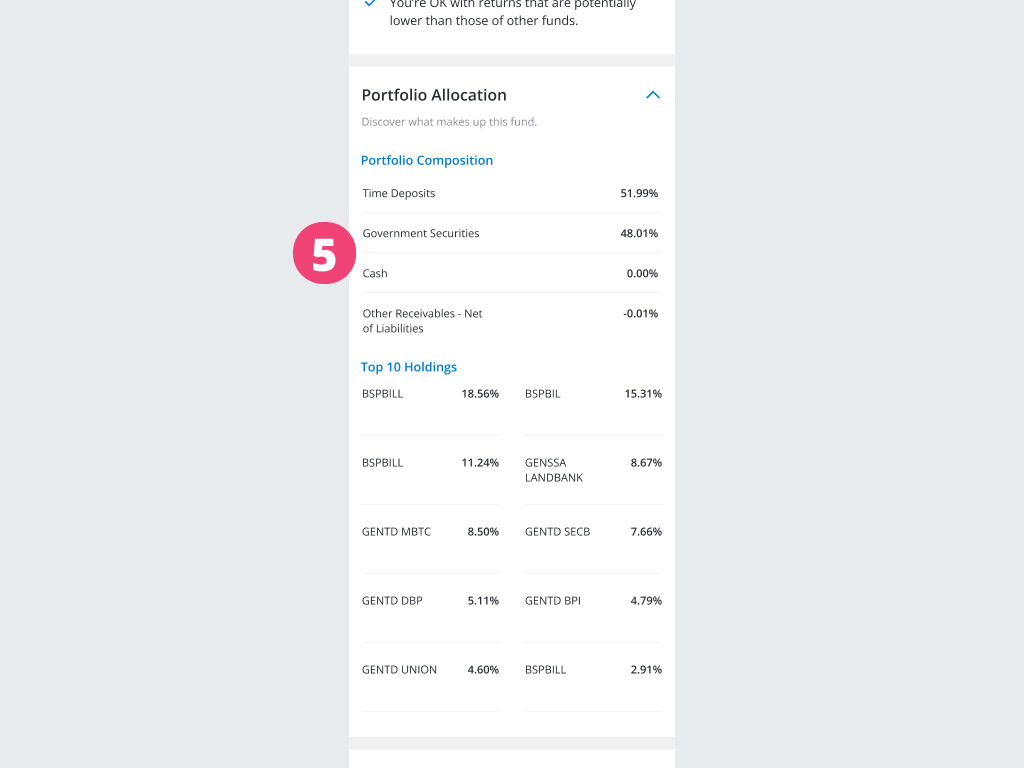

3. What it is

In this section, you’ll see the things that will help you make a decision on putting money in the fund. These are:

Minimum investment – This is the smallest amount you can put in the fund at the start. When you add money later on, the amount needed will be less.

Minimum auto-debit – Exclusive to Aspire funds, this is the smallest amount that will be automatically debited from your bank account and put in the fund every month.

Time horizon – This is the recommended time for you to keep your money in the fund to get the best results.

Assets – These are the major assets that the fund puts the money of its investors in to hopefully grow the value.

Days to withdraw – This is how long it takes for you to take some or all of your investment from the fund.

Trust fee – This is the fee charged for managing the fund. It is already incorporated in the fund’s NAVPU.

4. Invest in this fund if…

This is a list of things to consider before putting money in the fund. If you’re fully convinced after seeing all of them, you like what the fund has to offer, and your risk profile matches the fund’s suitability, you can consider it an option for your portfolio.

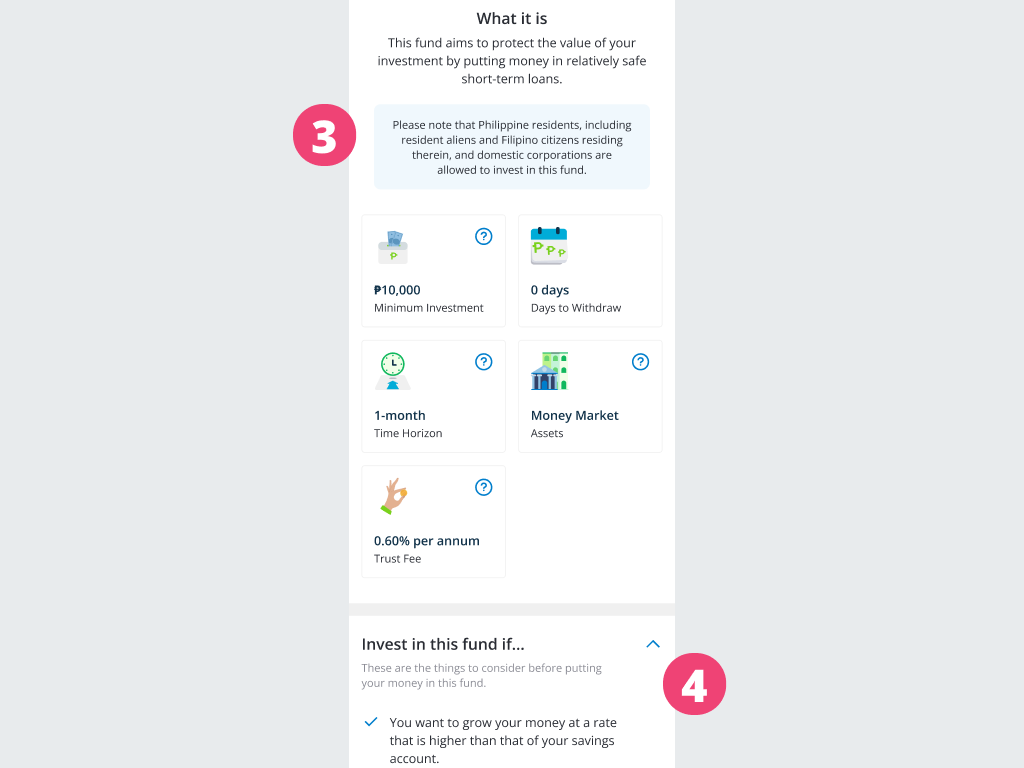

5. Portfolio Allocation

This shows the assets that the fund manager invested in to possibly grow the fund's value.

Portfolio composition – This includes the main types of assets that the fund invests in, such as equities, fixed-income instruments, and cash and equivalents.

Top 10 Holdings – This list shows the top products that make up the fund.

6. How you could risk your money

These are the risks that you’ll be taking with your money by investing in the fund. For your safety, you’ll have to confirm that you’ve read and understood the risks in order to put money in this fund.

7. Documents

In this section, you’ll be able to get even more information on the fund.

Fund fact sheet – This gives you the full fund details. Aside from what you can see in the product page on Earnest, you’ll be able to view things like the investment strategy and additional performance statistics.

.png)

.jpg)